Nobody likes shelling out for auto insurance. But given the greater financial burden of a car wreck001 Archives most of us simply grin and bear it, minus the grin. After all, mistakes happen and drivers are only human — for now.

But as we hurtle into the age of computer-operated, fully autonomous vehicles, car insurance as we know it is about to change — including how much we need to buy.

Most experts expect the first driverless cars to become available by the early 2020s. By the mid-2030s, industry analyst IHS Automotive projects, more than 75 million cars with autonomous capabilities will be on the roads.

“Pretty soon we won’t drive off a dealership; we’ll be driven,” says Donald Light, an analyst for technology consultant Celent.

The changes will only get more dramatic from there. Autonomous vehicles will not only enable safer travel but also shift the blame for most accidents away from the vehicles’ owners and toward the vehicle and software makers. That could leave auto insurance companies facing a dim future in which their business shrivels as the need for personal auto insurance fades.

Although the prospect of using driverless cars may be scary to some, we humans aren’t doing such a bang-up job behind the wheel. According to the National Highway Traffic Safety Administration, driver error is the main cause of a whopping 94% of crashes. (Other causes included vehicle failure and weather.)

“We either fail to see a dangerous situation, don’t make the right decision to avoid trouble or can’t execute the correct maneuver,” Light says. “All three areas are ones in which autonomous cars will perform much better than people.”

Based on some projections, the improvement will be staggering. Jerry Albright, principal of actuarial and insurance risk practice at KPMG, a research and advisory firm, estimates that car accidents will drop by 80% by 2040.

Driverless cars will do more than just reduce collisions — they’ll also change how we assign blame for accidents that do happen.

“Many people are already hesitant to assume fault when they’re the ones driving,” says Joe Schneider, managing director of corporate finance at KPMG. “Now imagine a computer is chauffeuring you. You’re certainly not blaming yourself for a crash then.”»

Although the issue of blame and liability is still murky, Light says the owners of autonomous vehicles won’t be on the hook for most crashes. Instead, the responsibility to pay damages will fall on the manufacturers and the hardware and software designers who create the self-driving systems.

By relinquishing decision-making to our cars, we’ll be able to purchase much leaner, cheaper insurance policies. For example, imagine needing only comprehensive coverage to pay for problems like car theft and hail damage that carmakers can’t control. Light estimates car insurance rates could shrink by up to two-thirds.

The first fully autonomous vehicles will be publicly available. Ridesharing companies such as Uber and Lyft will begin using driverless cars, perhaps even before they’re sold to the public, says John Matley, principal of insurance and technology for advisory group Deloitte.

Albright refers to this period as the “chaotic middle.” Self-driving cars will be in short supply, and the price tag may be too steep for many motorists — up to $10,000 more than today’s cars, according to IHS Automotive. Liability issues will take a lot of time to sort through, and the auto insurance market will have yet to take a hit.

There will be fewer cars overall on the road due to ridesharing, and at least 40% of vehicles will have partially autonomous capabilities — including frontal crash avoidance, lane-departure warnings and blind-spot monitoring — according to a Celent report. Light estimates the cost of personal auto insurance will have dropped by 5% to 20%.

There will be significantly fewer vehicles in use, and we’ll enjoy demonstrably safer roads, Matley says.

By now, he believes, total annual auto insurance revenue will have dropped from today’s level of about $200 billion to $140 billion.

A new normal: Ridesharing companies will operate fleets of driverless cars, and owning an autonomous vehicle will no longer just be for the wealthy. Matley believes the cost per mile of owning and operating self-driving cars will be cheaper than driving vehicles back in 2016. In addition to reduced car insurance costs, advances in lightweight construction will lower sticker prices for driverless cars and allow their owners to spend less on fuel.

Crash frequency will have plummeted, and car owners will have a minuscule need for insurance. Some of the largest auto insurance companies will leave the market altogether, Light says, while others will have to overhaul their business models to survive, focusing on commercial ridesharing or product liability coverage, or other services such as car maintenance.

By this point, Light believes, personal car insurance could cost close to 70% less than it does today. Or as he sums up, “We’ll all be having a beer to celebrate.”

Ultimately, consumers’ willingness to embrace this technology, despite initial hiccups, will determine if this timetable holds true.

Matley acknowledges there may be a rocky transition period, but he believes motorists’ reservations will start to crumble once they see driverless cars being used by ridesharing companies.

In Schneider’s opinion, a new culture of “mobility on demand” will prove too convenient to resist. “It’s going to click for a lot of people that driving is overrated,” he says.

Alex Glenn is a staff writer at NerdWallet, a personal finance website. Email:[email protected].

(Editor: {typename type="name"/})

Lehecka vs. Dimitrov 2025 livestream: Watch Brisbane International for free

Lehecka vs. Dimitrov 2025 livestream: Watch Brisbane International for free

The Joys of Yiddish Dictionaries by Ezra Glinter

The Joys of Yiddish Dictionaries by Ezra Glinter

March 5, 1815 by Sadie Stein

March 5, 1815 by Sadie Stein

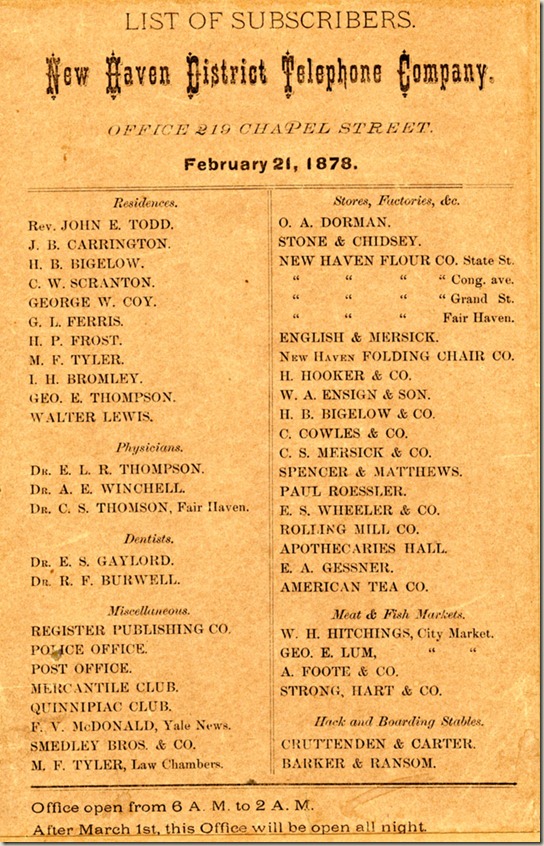

Happy Birthday, Telephone Book by Sadie Stein

Happy Birthday, Telephone Book by Sadie Stein

What Sa Nguyen uses to film TikToks that feel like FaceTime

Sa Nguyen grew to fame on her TikTok for her mukbang videos, but the Orange County, CA college stude

...[Details]

Sa Nguyen grew to fame on her TikTok for her mukbang videos, but the Orange County, CA college stude

...[Details]

Riding with Edna St. Vincent Millay: A Love Story by Ross Kenneth Urken

Riding with Edna St. Vincent Millay: A Love StoryBy Ross Kenneth UrkenFebruary 14, 2013First PersonT

...[Details]

Riding with Edna St. Vincent Millay: A Love StoryBy Ross Kenneth UrkenFebruary 14, 2013First PersonT

...[Details]

A Week in Culture: Claire Cottrell, Art Book Shop Owner and Editor by Claire Cottrell

A Week in Culture: Claire Cottrell, Art Book Shop Owner and EditorBy Claire CottrellFebruary 19, 201

...[Details]

A Week in Culture: Claire Cottrell, Art Book Shop Owner and EditorBy Claire CottrellFebruary 19, 201

...[Details]

Barnaby Conrad: Author, Matador, Bon Vivant, and Thorn in Hemingway’s Side by Lesley M.M. Blume

Barnaby Conrad: Author, Matador, Bon Vivant, and Thorn in Hemingway’s SideBy Lesley M.M. BlumeMarch

...[Details]

Barnaby Conrad: Author, Matador, Bon Vivant, and Thorn in Hemingway’s SideBy Lesley M.M. BlumeMarch

...[Details]

Best MacBook deal: Save $200 on 2024 M3 MacBook Air

SAVE $200: As of Feb. 10, the 2024 Apple MacBook Air (M3, 13-inch, 16GB RAM, 256GB SSD) is on sale f

...[Details]

SAVE $200: As of Feb. 10, the 2024 Apple MacBook Air (M3, 13-inch, 16GB RAM, 256GB SSD) is on sale f

...[Details]

Weirdest Titles of the Year by Sadie Stein

Weirdest Titles of the YearBy Sadie SteinFebruary 22, 2013Arts & CultureForget the Oscars: what

...[Details]

Weirdest Titles of the YearBy Sadie SteinFebruary 22, 2013Arts & CultureForget the Oscars: what

...[Details]

'Black Mirror' used books as clues in 'Beyond the Sea'

It's pretty rare that a prop in Black Mirroris for mere show — and that includes the books the

...[Details]

It's pretty rare that a prop in Black Mirroris for mere show — and that includes the books the

...[Details]

Bookish Cakes, and Other News by Sadie Stein

Bookish Cakes, and Other NewsBy Sadie SteinMarch 4, 2013On the ShelfHappy Monday. Here are some cake

...[Details]

Bookish Cakes, and Other NewsBy Sadie SteinMarch 4, 2013On the ShelfHappy Monday. Here are some cake

...[Details]

The Babelio sound machine is for babies. I love it anyway.

I'm one of those people who literally cannotsleep without white noise playing in the background. Oth

...[Details]

I'm one of those people who literally cannotsleep without white noise playing in the background. Oth

...[Details]

'Black Mirror' Season 6: The season's top 20 WTF quotes

The brilliance of the phrase "WTF" is that it can mean a lot of things.It can be a desperate plea. A

...[Details]

The brilliance of the phrase "WTF" is that it can mean a lot of things.It can be a desperate plea. A

...[Details]

Draper vs. Kokkinakis 2025 livestream: Watch Australian Open for free

15 of the best animal photos from 2020

接受PR>=1、BR>=1,流量相当,内容相关类链接。